IRS 1040 - Schedule 2 2025-2026 free printable template

Get, Create, Make and Sign pdffiller form

Editing schedule 2 online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040 - Schedule 2 Form Versions

How to fill out schedule 2 form

How to fill out 2025 schedule 2 form

Who needs 2025 schedule 2 form?

Complete Guide to the 2025 Schedule 2 Form

Overview of the 2025 Schedule 2 Form

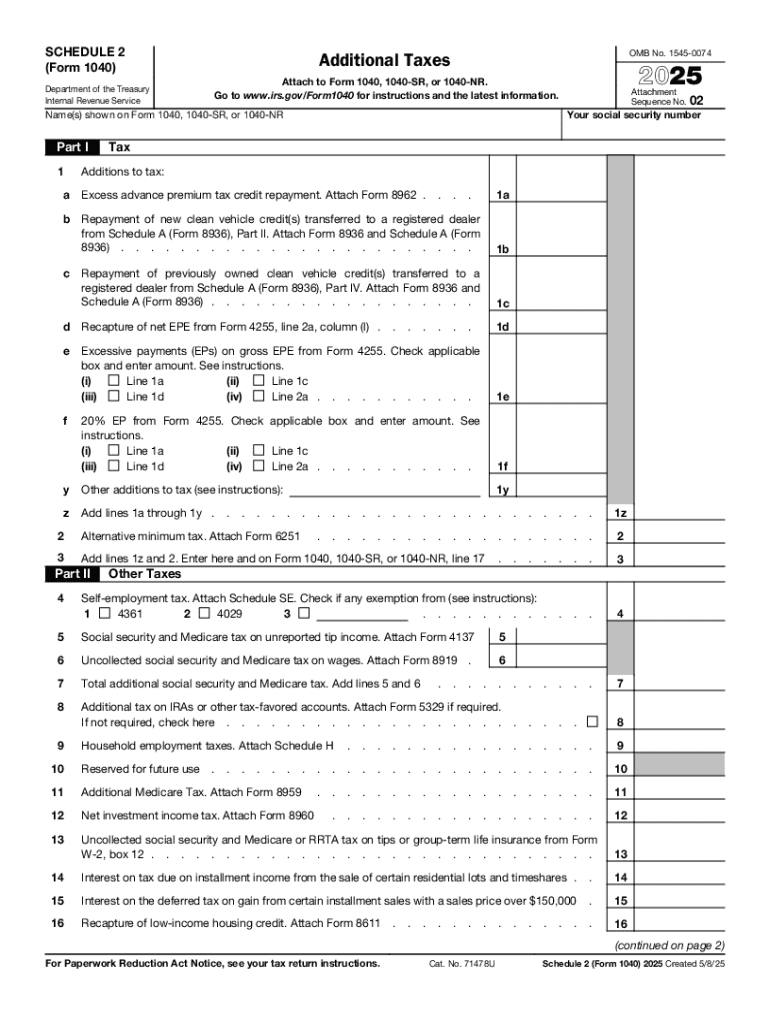

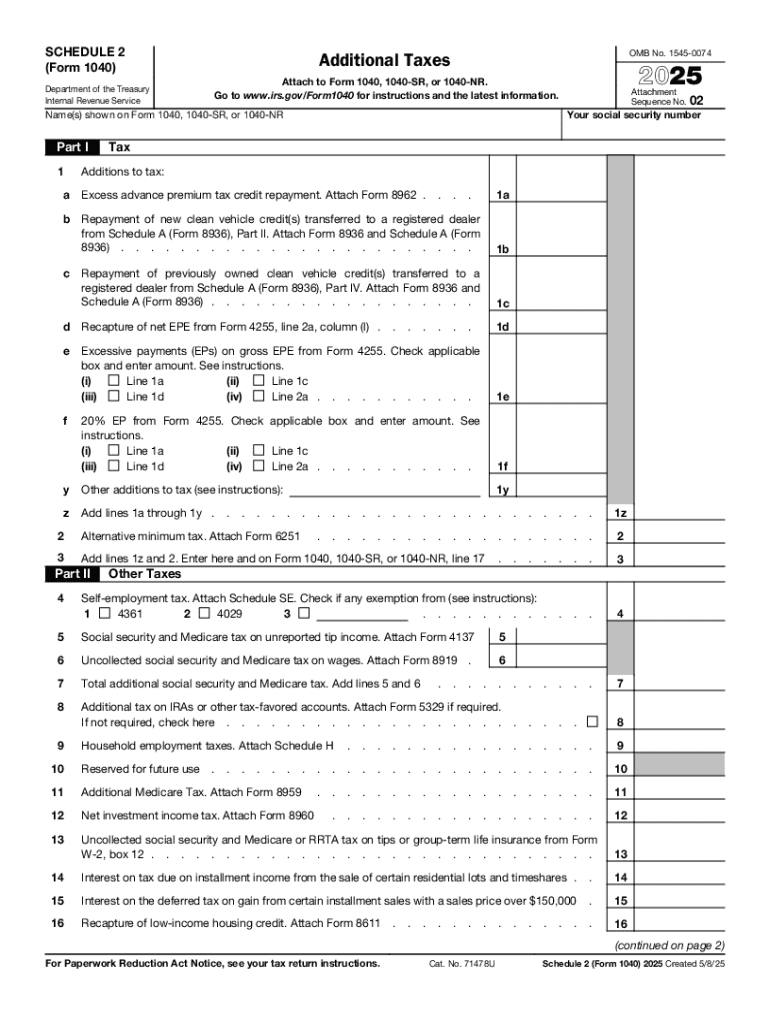

The 2025 Schedule 2 Form is an integral part of the individual income tax return process in the United States. This form serves as a supplementary document that allows taxpayers to report additional taxes owed, such as self-employment tax or alternative minimum tax. It essentially ensures that any crucial financial obligations that don't fall under standard income reporting are accounted for in a taxpayer's return. For both individuals and organizations, accurately completing the Schedule 2 Form is essential for maintaining compliance with tax laws and avoiding potential penalties.

Understanding the Schedule 2 Form is vital not only for tax compliance but also for optimizing one’s tax situation. It highlights any additional tax liabilities that may arise from various interactions with other tax provisions, ensuring that all owed taxes are reported correctly for the year.

Key changes in the 2025 Schedule 2 Form

The 2025 Schedule 2 Form has seen some significant updates compared to previous years. New lines or sections may have been added to address evolving tax laws and streamline the filing process. For instance, adjustments may include updated figures for various tax brackets or modifications pertaining to available deductions and credits, which are crucial for taxpayers aiming to minimize their financial obligations. Understanding these updates is essential for ensuring accuracy in filing.

Moreover, legislative changes can heavily impact the Schedule 2 Form. For 2025, any recent tax reforms will likely lead to alterations in the form’s structure or the specifics of what needs to be reported. It is crucial for taxpayers to stay informed about these legislative changes to understand how they might affect their filing and eventual tax obligations.

Who needs to file the 2025 Schedule 2 Form?

The requirement to file the 2025 Schedule 2 Form typically extends to individuals and organizations with specific income thresholds or types. Generally, taxpayers who report additional income subject to other taxes, such as self-employment or alternative minimum tax, must include this form with their returns. In particular, individuals who earned income from self-employment or received distributions from retirement accounts may find themselves needing to file this supplemental form.

It’s also important to recognize that different types of income and sources may prompt a need for the Schedule 2 Form. By understanding the scenarios that can require this filing, taxpayers can better assess whether they need to include the form in their submission to ensure compliance.

Preparing to fill out the 2025 Schedule 2 Form

Preparation is key when it comes to completing the 2025 Schedule 2 Form. Gathering essential documents such as tax documents, income statements, and any previous year forms is crucial for ensuring a smooth filing process. These documents provide the information necessary to accurately fill in the required data sections and make appropriate calculations.

To organize financial data effectively, consider creating a checklist of all the required documents. This could include documents such as W-2s, 1099s, and any relevant financial accounts. By collating this data before starting the form, you can minimize errors and expedite the filing process, making it easier to focus on completing each section accurately.

Step-by-step instructions for completing the form

Section breakdown

Completing the 2025 Schedule 2 Form involves a specific section breakdown that requires attention to detail. Each line must be filled with the appropriate figures based on your records. Be sure to carefully read the instructions provided for each line, as misunderstandings can lead to errors in tax liability calculation.

Common mistakes to avoid

When filling out the Schedule 2 Form, common mistakes can lead to significant issues. Some frequently seen errors include miscalculating deductions or misunderstanding the requirements of specific lines on the form. For example, filing without ensuring that all additional income is reported can result in penalties.

It’s also beneficial to have someone review your completed Schedule 2 Form to spot any potential miscalculations or omissions before submission. Engaging a tax professional can offer peace of mind, ensuring that all entries meet current tax laws and regulations.

Interactive tools for simplifying the process

To make the process easier, several interactive tools are available for taxpayers when preparing the 2025 Schedule 2 Form. Calculator tools, for example, can provide estimates of potential tax obligations, making it easier to understand one's financial landscape before filing. These tools can help reduce anxiety regarding unforeseeable tax liabilities.

Additionally, editable templates can be accessed through platforms like pdfFiller. Users can take advantage of pre-designed templates specifically for the Schedule 2 Form, allowing for efficient data entry and seamless edits to ensure accuracy in their submissions.

eSigning the completed form

Once the 2025 Schedule 2 Form is completed, eSigning can make the submission process more efficient. Using pdfFiller, taxpayers can electronically sign their forms without the need for printing, making the process faster and more environmentally friendly. eSigning provides the same legal validity as traditional signatures, ensuring that your filings are not only convenient but also compliant.

The steps for electronic signing via pdfFiller are straightforward. After filling out the necessary sections of the form, users can seamlessly add their eSignature with just a few clicks, thereby reducing administrative burdens and expediting the filing process.

Submitting the 2025 Schedule 2 Form

When it comes to submission methods, taxpayers have options for filing their 2025 Schedule 2 Form. The choices typically include e-filing through designated portals or submitting a paper file by mailing the completed form. E-filing is often faster and may offer immediate feedback about any errors, which is an essential benefit during the busy tax season.

For 2025, it is crucial for taxpayers to be aware of any specific submission tips to avoid potential pitfalls. Ensuring correct information is provided and the appropriate channels are utilized can help facilitate a smoother submission process. Additionally, check the IRS guidelines or state tax regulations for up-to-date forms and submission locations.

Post-submission: what to expect

After submitting the 2025 Schedule 2 Form, taxpayers can expect a processing timeline that varies based on submission method. E-filed forms usually process faster than those mailed in. It's important to keep a record of your submission and any confirmation received to ensure that it is all in order.

In case of issues such as missing information or discrepancies, the IRS may contact you for clarification. Being proactive and promptly addressing any issues that may arise will help maintain compliance and avoid further complications.

FAQs about the 2025 Schedule 2 Form

Common questions about the 2025 Schedule 2 Form often revolve around who needs to file it, how to address specific tax credits, and the implications of additional taxes reported. These inquiries highlight the importance of understanding the nuances within the tax form and the potential impact on one’s tax liabilities.

In cases where individuals run into trouble while filing, several troubleshooting tips can be beneficial. These may include seeking assistance via tax service portals or consulting with tax professionals who can clarify nuanced points regarding the Schedule 2 Form.

Additional tools and resources

For those preparing to fill out the 2025 Schedule 2 Form, accessing relevant government websites can provide invaluable resources and updates. The IRS website is a prime source for official instructions and updates on tax filing and related processes. Additionally, pdfFiller offers resources and templates designed to streamline the filing experience.

Leveraging pdfFiller resources contributes to a smooth filing process, empowering users to manage their documents efficiently. Utilizing cloud-based solutions can simplify the document management journey as it allows users to access forms anytime, anywhere.

People Also Ask about schedule 2

What happens if you don't have a Schedule 2?

What does Schedule 2 mean IRS?

Is Schedule 2 a Schedule C?

What is the schedule 2?

What is about Schedule 2?

Is it necessary to have a Schedule 1?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute schedule 2 online?

Can I create an electronic signature for signing my schedule 2 form 1040 pdf in Gmail?

How do I complete what does schedule 2 mean advance premium tax credit repayment on an Android device?

What is 2025 schedule 2 form?

Who is required to file 2025 schedule 2 form?

How to fill out 2025 schedule 2 form?

What is the purpose of 2025 schedule 2 form?

What information must be reported on 2025 schedule 2 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.